In this blog, we’ve been discussing the right sales metrics for every stage in the pipeline, starting with lead generation and then closing. This time around we’ll be discussing sales metrics for after the sale.

What are Sales Metrics?

What again are sales metrics? Sales metric is stand-alone data that tracks and measures the performance of an individual, a team, or the whole company or organization. Sales managers and leaders use sales metrics to track their teams’ progress, manage the sales pipeline, forecast sales opportunities, and monitor any possible setbacks.

The Key Sales Metrics for After a Sale

So you and your team have closed a deal… congratulations!

But the real work begins. At this stage, what’s most important is to track revenue, growth, and customer retention. And we have the key sales metrics for these.

1. Customer Acquisition Cost

As the name implies, customer acquisition cost (CAC) is expenses incurred in acquiring customers. These can include your marketing and advertising campaign costs, employee salaries, commission, transportation and representation expenses, mobile allowance, and all expenses incurred in using all other resources to make the sale happen.

Computing for your CAC is a little tricky. There’s a standard formula that adds total marketing expenses and total sales expenses and dividing the sum by the number of new customers acquired. If your variables are pretty straightforward, this is a good basic formula, but if there are other variables/factors concerned, such as the time period campaign ran in relation to the time period lead converted to a customer, the kind of customer (new vs returning), and the like, then you’ll need to tweak this formula. Here’s a good guide with some spreadsheet templates you can use to get started.

2. Sales Cost Ratio / Expense to Sales Ratio

This measures the profitability of a sale. What is the revenue earned from the sale in relation to the operational and other costs involved in making the sale (or your CAC)? Measuring the profitability helps you check if you need to scale up or scale down. You can also spot bad deals before complete damage is done, and change what needs to be changed. If profitability is bad, then you will need to make adjustments like lowering expenses or increasing pricing.

To calculate, divide your costs by revenue then multiply by 100 to get the percentage.

3. Sales Growth

In part 2 of this series, we mentioned Monthly Sales and how monitoring monthly sales establishes your team’s selling patterns and, more importantly, whether you and your team are improving, plateauing, or worse, declining. You can measure total sales by any period—monthly, weekly, bi-monthly, and so on—and whatever you choose will be your basis for monitoring your sales growth. Just make sure to keep it consistent.

To compute for your sales growth:

- Subtract the past period’s revenue (e.g. March 2019) from current period’s revenue (e.g. April 2019)

- Divide the difference by previous period’s revenue (e.g. April 2019)

- To get the percentage of sales growth between the two periods, multiply by 100.

You want to retain customers because it can increase revenue over an 18-24 months period by as much as 80%+, reduce customer acquisition costs by 30%+, and increase total customers by 1.5x.

Here are some customer retention metrics you can have in place:

- Repeat Customer Rate

To compute the percentage of customers coming back or repeatedly purchasing, simply divide the number of repeat customers by the total number of customers. To get the percentage, multiply by 100.

Do note that it’s important to use the same time period (weekly, monthly, etc.). The higher the repeat customer rate, the better.

- Customer Attrition Rate / Customer Churn Rate

You lose customers, that’s a fact; but then you will need to keep track of this. To calculate: number of lost customers over a time period is divided by the number of customers in the beginning of that period. To get the percentage, multiply by 100.

The lower your attrition or churn rate, the better.

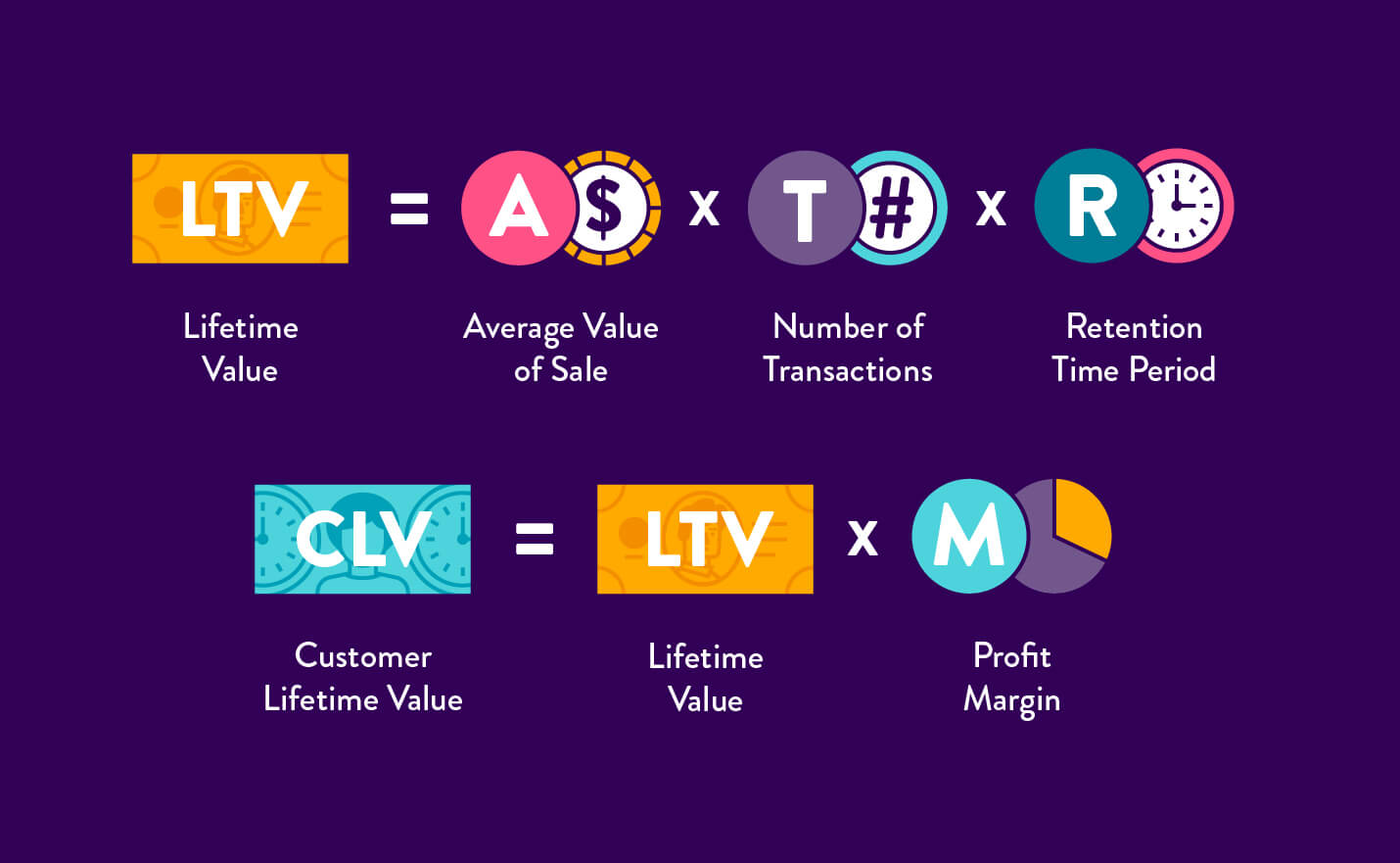

- Customer Lifetime Value

The Customer Lifetime Value (CLV), or sometimes called Lifetime Value (LTV), is expected revenue in the duration of a relationship with a customer. There are a lot of variables involved in CLV and so it’s a little tricky to compute for this (and we suggest that you have someone from Finance help you out). But this is a pretty good formula.

You can read more on CLV here and here.

Photo by rawpixel.com from Pexels